The Office of the Comptroller of the Currency (OCC) has issued revisions to its civil monetary penalty (CMP) policy that is in effect as of February 26, 2016. The revisions apply to national banks, bank service companies, service providers and federal savings associations.

The new policy includes a revised CMP Matrix that includes grading criteria and weighted scores for violations in four areas:

- Banking laws/regulations

- Conditions imposed in writing or covered by a written agreement

- Unsafe or unsound practices

- Breach of fiduciary duty

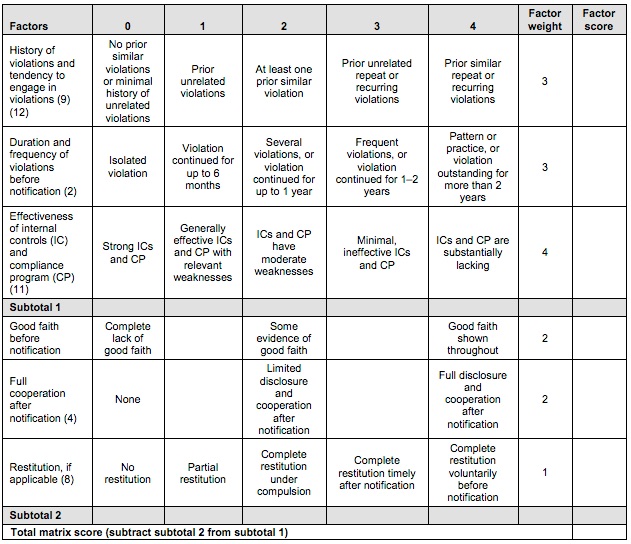

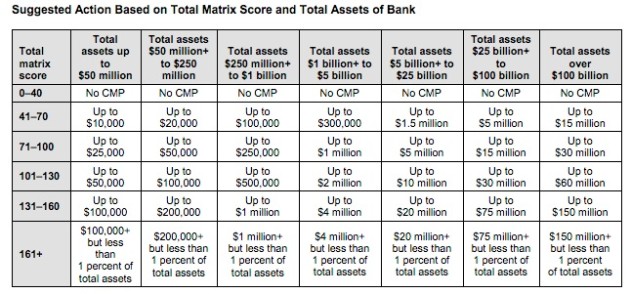

The matrix reveals the factors the OCC uses to determine the amount of CMP assessments, including — for the first time — the size of the institution, as well as the severity of the violation, history of past violations, existence and effectiveness of internal controls, loss or harm, and several other factors. The new policy manual also includes a schedule of penalties divided by asset size.

The new CMP Matrix is as follows:

The attorneys at Glass & Goldberg in California provide high quality, cost-effective legal services and advice for clients in all aspects of commercial compliance, business litigation and transactional law. Call us at (818) 888-2220, send an email inquiry to info@glassgoldberg.com or visit us online at glassgoldberg.com to learn more about the firm and to sign up for future newsletters.